Oxfordshire Recruitment Market Overview 2024

Oxfordshire Recruitment Market Overview, January 2024

Compiled by Allen Associates with data insights and analysis by Indeed Hiring Lab

Download PDFSetting the scene

The mood among Oxfordshire-based employers appears to be relatively upbeat with many forging ahead with their plans to develop and grow their businesses in 2024.

In an anecdotal poll carried out at Allen Associates HR Hub in January, 34% of attendees said they were confident and optimistic about the year ahead. A further 48% said they were cautious but continuing to push forward with their plans. Overall, 58% said they would be expanding their workforce.

This feedback comes at a time when GDP is expected to grow by a modest 0.4% and the macro-economic picture remains uncertain as we wait to see the impact of higher interest rates, falling inflation, ongoing wage growth, low unemployment and a myriad other factors.

Inflation has receded from the double digits recorded in 2023, falling to 4% in January. This is still above the Bank of England’s 2% target but lower than annual pay growth for the first time in 18 months, offering some relief to cash-strapped households.

Interest rates are predicted to come down towards the middle of 2024 assuming inflation continues to fall and wage growth pressures continue to ease as we move through the year.

Cuts to National Insurance rates and the largest-ever increase in the National Living Wage are among other measures expected to stimulate employment and productivity.

What does this mean for recruitment?

The labour market has been cooling steadily since the second half of 2022 when we experienced a post pandemic hiring boom. Jack Kennedy, a Senior Economist at Indeed Hiring Lab, which analyses data accessed through the world’s biggest jobs platform, Indeed, as well as other sources, discusses what this means for recruitment:

Looking at data trends published by the ONS and Indeed (shown in the graph below) which uses the eve of the pandemic in February 2020 as the baseline, the fall out is clear, with job vacancies broadly having returned to their pre-pandemic levels. By mid-2022 however, job vacancies had soared to 50-60% above pre-pandemic levels as hiring surged following the reopening of the economy and employers tried to plug the gaps left by people who had exited the workforce due to ill health or for lifestyle reasons, while also wanting to expand and gear up for growth.

While 2024 is being regarded by many as the long-awaited ‘return to normal’, recruitment is still likely to be challenging. Low unemployment, skills shortages, sector-specific challenges and fewer jobseekers continue to frustrate employers’ ability to grow and develop as they would like.

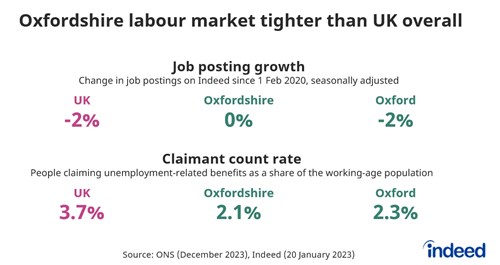

Nationally, unemployment is expected to rise slightly from 4.2% to 4.6%. In Oxfordshire, joblessness is lower than the UK average, with the rate of unemployment claims running at 2.1% versus 3.7% nationally. There has been a modest uptick in the number of redundancies and layoffs, with a few high profile examples making media headlines, but not enough to impact the tight labour market the UK is continuing to experience.

In addition to regional variations, demand for workers is sector led, with social services still posting double the number of job vacancies than it was before the pandemic. Healthcare and education are also among those that are struggling to fill their vacancies.

At the other end of the spectrum, vacancies in the software development sector are 40% down on pre-pandemic levels in the UK as part of a global tech downturn. Driving, beauty and wellness sectors have also seen a significant drop in job openings.

How to attract candidates in a tight labour market

Pay remains key

The UK’s year-on-year wage growth of 6.6% is significantly higher than in the US and Euro areas – and, as mentioned earlier in this report, workers should feel the benefits of any pay increases as inflation continues to fall.

Again, there are regional and sector variations, with in-person services such as childcare, cleaning, retail and security, seeing larger than average increases of between 7% and 10%.

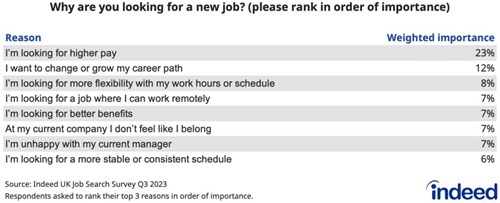

However, wage growth is expected to cool this year and jobseekers’ expectations may need to be managed. According to Indeed’s most recent quarterly survey, 23% of jobseekers cited pay as their number one reason for looking for a new job, in line with previous years.

This was followed by other motivating factors, such as career development, flexibility and benefits (as set out in the chart below).

Advertise salaries

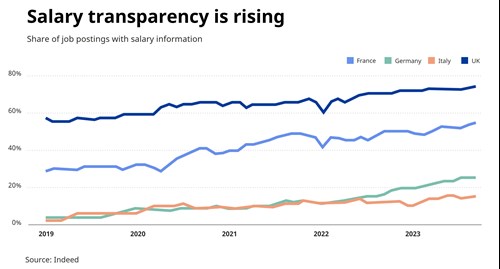

After a long tradition of not advertising salaries, employers are increasingly realising that they need to if they want to attract the best people. Three-quarters of all job postings on Indeed now containing information about pay (as shown in the graph below).

In an anecdotal poll conducted during Allen Associates’ HR Hub in January, 53% of the Oxfordshire-based HR professionals and employers who attended the event said they published salaries in their job ads.

Kate Allen, Executive Chair and Marketing Director at Allen Associates, said:

“The numbers were too small to be statistically significant, but they were lower than expected and do contrast with Indeed’s extensive national research. It’s possible that Oxfordshire employers are missing a trick by not publishing their starting salaries and they could consider addressing this to attract more candidates. We always advise our clients to benchmark their salaries to ensure they are as competitive as possible and to promote them, if it’s appropriate to do so.”

Kate Allen, Allen Associates Executive Chair and Marketing Director

Be flexible!

Jobseeker surveys consistently show that flexible working is still highly prized and employers that offer it have a distinct advantage over those that don’t.

Indeed’s latest research shows that nearly 3% of all job searches in early 2024 include flexible working criteria, up tenfold from pre-pandemic. This is significant, given that jobseekers’ search focus will first and foremost be on job titles and locations.

Almost 16% of jobs posted on Indeed now include remote or hybrid working terms, up from 3% in 2020.

Indeed’s research also reveals that jobs offering hybrid and remote working were filled 5% quicker than those that didn’t – and they also saw a 20% uplift in the number of applications.

While hybrid working and remote working are still widely expected for office-based roles, there are other sectors where this is difficult to implement. These employers can make themselves more attractive to candidates by being more flexible with hours of work, days of work and shift patterns.

Less than 1% of job postings on Indeed offer a four day working week but this is a growing trend. It’s particularly prevalent in sectors such as healthcare, childcare and food service, where employers are using the four day working week to compete with those advertising remote and hybrid working – and this trend looks set to rise.

Overseas interest in UK roles

Cross-border searches have rebounded strongly since the pandemic with about 6% of searches on Indeed coming from people based outside of the UK. A recent shift in migration rules directed towards higher paid roles in sectors such as healthcare for example, have generated lots of interest from applicants in Commonwealth countries. There has also been a rise in applications from jobseekers from Hong Kong and Ukraine.

The impact of AI on jobs

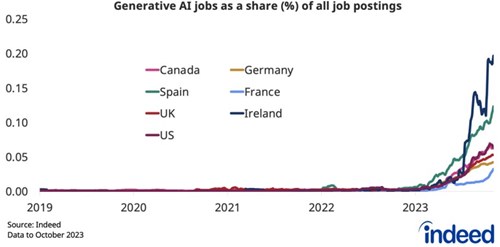

We have seen a phenomenal rise in the deployment of generative AI tools and many of these are being widely used by candidates to compile their CVs and job application letters and to support their search, as well as by hiring managers and HR teams who are using AI to help filter applications and shortlist candidates. They are also being increasingly widely used across industry sectors to enhance roles, productivity and performance.

A tiny 0.01% of job postings on Indeed in January 2024 directly relate to generative AI but if this rate of growth is sustained, it will soon become a significant feature of job postings.

Indeed conducted research to better understand the disruptive effect of AI and the types of roles that are most likely to be displaced. They looked at various skills data in their job postings and asked Chat GPT to rank its proficiency in performing them. Chat GPT rated itself as being able to perform well in 80% of the skills listed in one quarter of the jobs – and 50% of the skills listed in half of the jobs.

Perhaps unsurprisingly, jobs that require a high level of in-person engagement, empathy and manual work, were the least affected with Chat GPT rating its ability to perform these tasks poorly.

With AI now widely predicted to be a major disruptor, employers are already trying to understand the impact of AI on their workforce and jobs so that they can better understand how and where they will need to evolve.

Eleanor Bromage, Managing Director at Allen Associates, said:

“Most of our clients already understand the value of personal development and invest in training,

whether that is through large scale, structured training programmes or more ad hoc training to

meet individual needs.

Oxfordshire already has acute skills shortages in key areas but this is likely to be exacerbated by AI and our advice to employers is to watch the market intently and continue to retrain and upskill so that they can move with the times and compete effectively.”

Eleanor Bromage, Allen Associates Managing Director

How does Oxford and Oxfordshire’s labour market compare with the rest of the UK?

The Oxfordshire labour market is tighter than the UK overall with a lower rate of claimant count unemployment at just 2.1%. The number of job vacancies in Oxfordshire has returned to pre-pandemic levels but candidate supply issues and skills shortages remain, making recruitment challenging.

In the most recent Impact report by the Oxfordshire Local Enterprise Partnership (OxLEP), businesses identified their five biggest areas of need. Interestingly, these did not include raising finance, which suggests that in spite of the challenges of recent years, cash is not one of the key issues keeping business leaders awake at night.

Instead, Oxfordshire businesses want more support in:

- Growing their customer base

- Developing a business growth plan

- Improving their marketing and communications

- Upskilling staff and/or expanding their workforce

- Launching a new or different product to market

Indeed’s Senior Economist, Jack Kennedy, agreed that developing a skilled workforce fit for the future, through a combination of internal upskilling programmes and recruitment, would continue to be a key theme in 2024.

He said: “The UK labour market will likely continue to cool in 2024 as the hiring peaks seen in 2022 flatten, bringing activities back to their pre-pandemic levels. However, recruitment challenges are likely to remain as we’ve yet to bridge the skills gap or address the severe shortage of candidates in some areas.”

Jack Kennedy, Senior Economist, Indeed Hiring Lab

Hiring in Oxfordshire

If you’re looking for quality, pre-interviewed candidates for your business support roles

in Oxford or elsewhere in Oxfordshire, we would love to hear from you!

Based in Oxford, Allen Associates has been matching great people to roles and employers for more than 25 years. We apply the same rigorous recruitment process to our temporary and permanent vacancies so whatever your needs, you can be assured of an excellent service underpinned by passion, personality and integrity.

For support with your next hire, please call us on 01865 335600, email hello@allen-associates.co.uk or use our register your vacancy form.

Useful contacts and more insights

Allen Associates runs monthly webinars on a wide range of people management topics led by guest speakers as well as quarterly Employment Law Updates with our legal partner, RWK Goodman. To find out more and register for these free events, please visit Allen Associates HR Hub.

The very latest data and insights on the UK labour market are available at Indeed Hiring Lab.

Recruitment industry news and information is available from the Recruitment & Employment Confederation (REC).

For more on the Oxfordshire economy, visit the Oxfordshire Local Enterprise Partnership (LEP).

Previous Oxfordshire Recruitment Market Overviews are available to download from Allen Associates Knowledge Centre.