Oxfordshire Recruitment Market Overview February 2025

Oxfordshire Recruitment Market Overview, February 2025

Compiled by Allen Associates with data insights and analysis by Indeed Hiring Lab

Download PDFHiring trends and what they mean for employers

2025 looks set to bring some challenges to the employment market, but also offers considerable opportunities. Here at Allen Associates we’ve seen first hand how employers are adapting their hiring strategies in response to current conditions. While some businesses are taking a more cautious approach, demand for top talent remains high and securing the right people continues to be a priority for many of our clients. The best candidates are still hard to find and businesses that take a proactive approach to hiring are definitely gaining a competitive advantage.

The HM Treasury monthly survey of independent economic forecasters shows that marginally faster growth is expected in the UK economy in 2025, but it will still be at a fairly subdued pace. Growth is anticipated to be 1.2% for the current year, so it will be slightly faster than the 0.8% that was expected.

The Bank of England is expected to cut interest rates during the year, providing some support for the economy, while higher government spending on public services is expected to provide some incentive for growth.

The unemployment rate is expected to rise modestly but will remain fairly low at 4.5% by the end of 2025.

Inflation is generally expected to increase a little in the short term, driven by higher energy and food prices, and also possibly as businesses increase prices to partially offset April’s increase in Employer’s National Insurance Contributions.

Government Policies such as the rise in Employers’ National Insurance Contributions are likely to drive some combination of cost reduction and/or higher prices from businesses.

The National Living Wage will increase to 6.7% increase for the main rate.

The Government’s Workers’ Rights Bill contains a number of employment reforms that have been proposed but are not expected to take effect until at least 2026.

The Government also indicates plans for additional recruitment in Public Sector hiring especially for teachers and police officers, and has announced wider economic plans around areas including house building, infrastructure and green energy which is expected to boost these sectors.

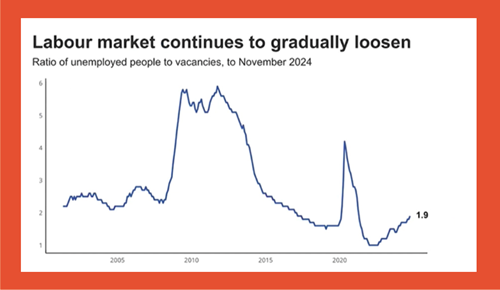

Nationally, the latest ONS data shows that the UK labour market has continued to loosen in recent months which means that hiring has become easier than it was 2-3 years ago, but it’s still not necessarily easy for employers. There are now 1.9 unemployed people for every vacancy in the economy – up from a low of 1.0 in 2022.

Labour Market continues to gradually loosen

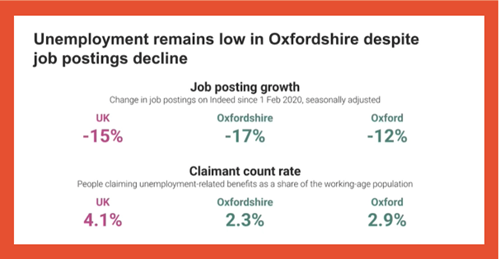

Oxfordshire has seen a decline in job postings of around 17% from pre-pandemic levels, and in Oxford itself, that figure is 12%. Both figures are close to the national trend. Unemployment rates are 2.3% in Oxfordshire and 2.9% in Oxford, against a national UK average of 4.1% indicating that the Oxfordshire labour market remains tight.

Three things to watch

1. Interest rates

Some financial markets expect a couple of base point reductions from the BoE but some expect more, perhaps as many as five or six, if the economy turns out to be weaker than the BoE’s expectations. In this scenario it may need to cut rates more aggressively in order to try to stimulate the economy.

2. Layoffs

There has been no spike in redundancy notices, which is important to keep unemployment in check, and the number of potential redundancy notifications has remained fairly low in recent months.

Company insolvencies remain low but the number of businesses in financial distress rose towards the end of last year. Many businesses are financially stretched at the moment which could be due to increases in their payroll costs.

Small businesses are particularly vulnerable to insolvencies which might impact on labour market figures.

3. Geopolitics

Geopolitics is an ever-present source of risk for the global economy, and the new administration in the USA has indicated that there will be changes to trade policy, starting with tariffs.

Uncertainty continues with conflicts in many areas that could impact the world economy, for example, through energy prices.

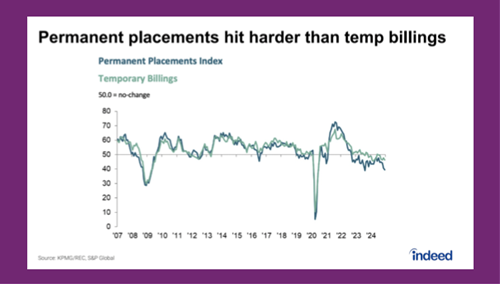

Permanent placements versus temporary billings index

Permanent placements fell in December at the fastest rate since August against temporary billings according to The Recruitment and Employment Confederation’s (REC) monthly survey of recruitment consultancies.

The UK has experienced a more pronounced slowdown in job postings than other countries, and it is the only one out of Australia, France, Ireland, the USA, Canada, Germany and France where job postings are below their pre-pandemic baseline.

The latest data indicates that job postings are around 14% below pre-pandemic levels, whereas in many of these other countries, they remain comfortably above pre-pandemic levels. The UK also saw the sharpest year-on-year slowdown during 2024 out of all of these countries.

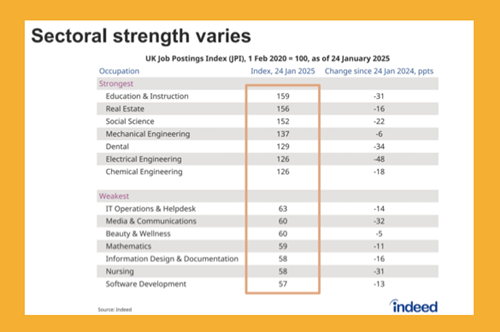

Sectoral variation

Education and Instruction job postings are now 59% above pre-pandemic levels. Real Estate, Social Science, Legal and several Engineering categories are among the more robust performers.

At the other end of the scale, tech categories, including Software Development, have slowed quite significantly. Job postings in those categories are well below pre-pan- demic levels

Trends for the first half of 2025

1. Remote job postings have declined

There has been a decline in in high-remote categories such as Tech job postings with remote options. Middle remote categories, such as Administrative Assistants, Customer Service, Education, Installation and Maintenance, and some Healthcare categories, are close to pre-pandemic levels and have fallen least. Low remote category job postings, such as Hospitality and Retail, have been minimally impacted.

2. Regional job variations

London and the South East saw job postings fall the furthest since before the pandemic, reflecting a sectorial mix with a greater bias towards professional categories.

Areas with the greatest reliance on public sector jobs, for example, have tended to be more resilient and less exposed to large cyclical downturns.

3. Zero Hours Contracts

There has been continued growth in Zero Hours Contracts postings through to the end of December 2024, rising to about 2.1% of all job postings. We will continue to monitor how the legislation will affect both employers and employees in light of the forthcoming legislation.

Sectors such as Sports, Social Care, Security and Public Safety, and Hospitality and Tourism have the highest prevalence, but there has been growth in their proliferation across a range of other occupations.

4. Pay trends

Indeed’s Wage Tracker shows that the UK continues to see stronger wage growth than countries in the Euro area or the USA. The figures are down slightly from a peak of around 6.5% at 6.1% but that represents almost double the figures in the Euro area and the USA.

A number of categories are still seeing strong wage growth strength, with Security and Public Safety leading at 8.6% year-on-year. In December, Retail, Customer Service, Cleaning and Sanitation, Food Service and Loading and Stocking were still seeing robust growth in advertised wages.

Quarterly survey data from job seekers indicates that over 20% of survey respondents in Q4 of 2024 say higher pay is the number one reason they are looking for a new job.

The Oxfordshire labour market

In terms of the Oxfordshire labour market, whereas we’ve seen a decline of around 14-15% in job postings from pre-pandemic levels across the UK as a whole, in the Oxfordshire region we’ve seen a slightly bigger increase, with job postings down 17% in Oxfordshire, and 12% down in Oxford itself. Both of these figures are close to the national trend.

Unemployment, as measured by claimant rate counts is around 2.3% in Oxfordshire and 2.9% in Oxford, against a national UK average of 4.1%. This means that the Oxfordshire labour market remains tight.

Recruitment advice for Oxfordshire employers

The team at Allen Associates has been supporting businesses in PA & Administration, Marketing, HR, and Finance recruitment across Oxfordshire for over 27 years. As we enter 2025, the employment market presents a mix of challenges and opportunities, with businesses adjusting their hiring strategies in response to economic conditions, evolving workforce trends, and shifting business needs.

Kate Allen, Founder & Executive Chairman at Allen Associates

“The labour market in Oxfordshire remains tight, with unemployment lower than the UK average. While hiring has become easier compared to the peak challenges of 2022, securing top talent is still competitive, and businesses that take a proactive approach to recruitment are gaining a clear advantage.

The cost of employing staff continues to rise due to increases in National Insurance Contributions and the National Living Wage. Employers have to be more strategic, balancing financial pressures with the need to attract and retain top-tier talent. The demand for flexibility - both in job structures and hiring strategies - has never been greater.

Industries such as Construction, Infrastructure, Engineering, Green Energy, and Public Services are expected to see growth, driven by government investment. However, these sectors face ongoing skills shortages, which could contribute to wage inflation and create further hiring challenges.

We are also seeing a strong focus on pay transparency and workplace flexibility - factors that continue to influence candidate decision-making. Employers that prioritise these areas will find it easier to attract and retain skilled professionals in the months ahead."

Eleanor Bromage, Managing Director at Allen Associates

”Economic uncertainty has led many businesses to adopt a more cautious approach to hiring, with some reducing permanent recruitment in favour of temporary staffing solutions. Since the start of the year, we have seen a further slowdown in permanent placements, with businesses carefully assessing costs and headcount requirements before making long-term commitments.

Despite this, the demand for skilled professionals remains high. Many employers are navigating workforce shortages by leveraging temporary staffing to bridge gaps, support business continuity, and manage peak workloads without the financial risk of permanent hires.

The ability to remain agile is critical in 2025. We always advise our clients to consider a hybrid hiring approach, balancing permanent roles with temporary placements to maintain business resilience. Engaging with trusted recruitment specialists can help employers access top talent quickly while reducing administrative burdens.

With the Bank of England expected to cut interest rates, we anticipate a gradual shift in business confidence, which could encourage a return to longer-term hiring strategies in the latter half of the year. For now, businesses that remain flexible, prioritise talent retention, and take a data-driven approach to hiring will be best positioned for success in Oxfordshire’s evolving labour market."

Key features of the Oxfordshire recruitment market

The following summary has been compiled by Allen Associates based on their first-hand experiences of working with candidates and clients on business support roles across Oxfordshire;

Flexible working is still the number-one employee benefit across all age groups, demographics and sectors. 17% of job postings in December 2024 mentioned flexible working. It’s a great way for employers to remain competitive in the job market, at a time when their competition may be pushing in the other direction

Recently there has been an increasing number of job postings containing neurodiversity keywords, offering flexibility for different types of workers. It has risen to around 3.8% of job postings in the UK, up from 1% in 2018

Generative AI jobs such as Accountancy and Software Development are rare but growing fast.

Job postings are declining in Oxfordshire, bringing recruitment challenges for candidates, however, unemployment remains below the national average.

What are Oxfordshire employers looking for in their new hires?

Skillsets that add value and enhance existing teams

Education and qualifications

Technical / IT skills in particular

Specialists rather than generalists

Excellent soft skills

Loyalty and commitment

Demonstrable knowledge and understanding of their new employer’s business

Ability to hit the ground running, adaptable and agile

What are candidates looking for from their new employers?

Flexibility

Competitive rates of pay

A good work / life balance

Autonomy and trust

Career and personal development opportunities

People-centric policies and a supportive culture

Organisations with CSR and ESG credentials that are committed to ‘giving something back’

Hiring in Oxfordshire

If you’re looking for quality, pre-interviewed candidates for your business support roles in Oxford or elsewhere in Oxfordshire, we would love to hear from you!

Based in Oxford, Allen Associates has been matching great people to roles and employers for more than 27 years. We apply the same rigorous recruitment processes to our temporary and permanent vacancies, so whatever your needs, you can be confident of an excellent service underpinned by passion, personality and integrity.

Useful contacts and more insights

Allen Associates runs monthly webinars on a wide range of people management topics led by guest speakers as well as quarterly Employment Law Updates with our legal partner, RWK Goodman. To find out more and register for these free events, please visit Allen Associates HR Hub.

The very latest data and insights on the UK labour market are available at Indeed Hiring Lab.

Recruitment industry news and information is available from the Recruitment & Employment Confederation (REC).

For more on the Oxfordshire economy, visit the Oxfordshire Local Enterprise Partnership (LEP).

Previous Oxfordshire Recruitment Market Overviews are available to download from Allen Associates Knowledge Centre.