Oxfordshire Recruitment Market Overview - July 2025

Recruitment is getting harder, here’s why...

As we move into the second half of 2025, the UK labour market is exhibiting clear

signs of a slowdown. Nationally, job vacancies have declined for nearly two years, with employer confidence dampened by tighter economic conditions and rising employment costs. Despite historically low redundancy levels, this cooling environment is making recruitment more competitive and complex, with more candidates per vacancy but fewer truly qualified or committed applicants. Shifting workforce expectations, the increasing influence of AI, and uneven economic growth across sectors and regions are reshaping the hiring landscape, challenging employers to adapt quickly and strategically.

In Oxfordshire, these national trends are being felt acutely. Long known for its economic resilience and skilled workforce, the region is now experiencing slower hiring, increased salary expectations, and a persistent shortage of suitably qualified candidates. Employers are navigating a delicate balancing act: managing higher operational costs while striving to attract and retain top talent in a highly competitive and evolving job market. With hybrid work remaining in demand and workplace culture playing a critical role in candidate decision-making, businesses are under pressure to modernise their recruitment strategies.

This report by Allen Associates explores the challenges and opportunities facing Oxfordshire employers in the second half of 2025, offering insights to help them stay agile and competitive in a complex hiring environment.

Despite recent signs of stabilisation in the local economy, recruiting the right people remains difficult and, in some respects, even harder than before. Employers across Oxfordshire continue to face complex market dynamics shaped by national trends, skills mismatches, and shifting candidate expectations.

We’ve reviewed the latest data from the Office for National Statistics (ONS), Indeed Hiring Lab and our own activity to provide an up-to-date view of what’s happening across the region and what it means for hiring managers.

A cooling labour market

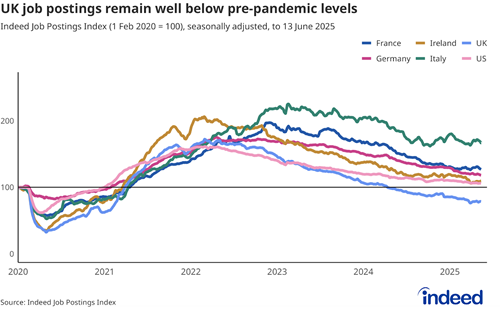

Nationally, the UK labour market is cooling. According to the ONS, job vacancies have fallen for the 23rd consecutive month(1) (as of May 2025), reflecting weaker employer confidence and tighter economic conditions.

Although redundancies remain historically low, this slowdown is creating a more competitive job market with fewer available vacancies and more candidates competing for each role.

Oxfordshire isn’t immune

While Oxfordshire has traditionally fared better than many regions, recent indicators show it is now following the national trajectory. Our own data highlights a modest drop in new job briefs and slightly longer hiring timelines across HR, Administration, Marketing, and Finance roles. Although some employers may feel reassured by a greater volume of applicants, it doesn’t necessarily make recruitment easier.

More candidates, but not always the right ones

The increased number of job seekers per vacancy is creating false impressions of ease. Employers may see 15 to 20 applicants per role, but often struggle to find individuals with the right skills, experience, or cultural fit. As a result, the recruitment process can still feel lengthy and uncertain. This is particularly true for specialist roles or positions that offer hybrid flexibility, where demand remains high.

Why it’s still hard to hire

Even with more candidates available, several persistent challenges remain:

Many applicants are not actively job-seeking but are “just looking”, leading to high drop-out or non-engagement rates.

Candidate expectations around salary, benefits, and flexibility have evolved rapidly and not all employers have kept pace.

Candidates are more cautious about moving roles, particularly in sectors where economic pressures continue to loom.

The value of recruitment expertise

For employers with strong brand appeal or attractive job offers, this market might seem favourable. But in reality, securing and retaining the right people still requires time, resources and a focused approach. If you’re seeing high application volumes, it may be tempting to manage the process in-house, but screening, shortlisting and managing candidate expectations remain time-consuming and complex.

Now more than ever, recruitment partners like Allen Associates can add value not just by accessing hidden candidate networks, but by providing strategic advice, market insights and hands-on support.

UK economic trends

According to HM Treasury’s Forecasts for the UK economy(2), growth remains subdued at 1.1% as of June 2025. However, rising wages are expected to support consumer spending. Increased government investment in sectors such as STEM, defence, energy, transport and affordable housing is anticipated to stimulate job creation and raise growth projections to 1.2% for the next 12 months, 0.4% higher than initially forecast(3).

Business and consumer confidence are confusing. While some indicators show room for positivity, others reflect a more negative viewpoint. Consumer confidence has seen some uptick, but remains sensitive due to concerns about the economy and cost of living. Business confidence has fluctuated, with some sectors experiencing gains while others show declines.

Despite the Bank of England’s Monetary Policy Committee (MPC) leaving interest rates unchanged at 4.25%(4), many analysts predict that the Bank of England may implement as many as two interest rate cuts before the end of the year, potentially reducing the base rate to 3.75%(5). Such a move could ease financial pressures for businesses and consumers alike.

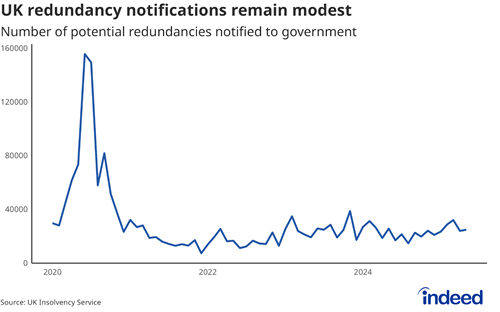

April’s increases in employment costs, most notably the National Minimum Wage and National Insurance Contributions, have had a tangible impact on hiring activity. However, contrary to expectations, these increases have not resulted in widespread redundancies.

The UK labour market

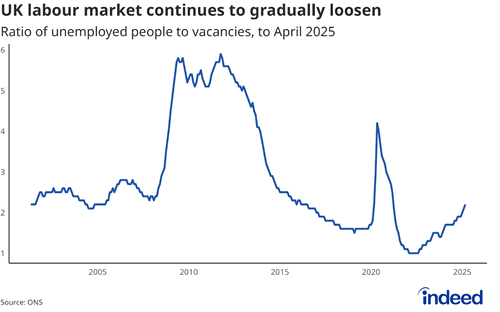

The UK labour market is gradually loosening, with a modest rise in unemployment. February to April 2025 saw an increase in the number of unemployed people per vacancy, from 1.9 in the previous quarter up to 2.2 (6). In addition, the number of payrolled employees has also fallen during 2025 and, as of May of this year, stands at 30.2 million (7). This is a drop of 0.9% or the equivalent of 274,000 people.

A recent report by the Recruitment and Employment Confederation (REC) noted that the supply of labour has expanded by its steepest rate since November 2020, impacting permanent placements, which have dropped at the fastest rate in 22 months.

There are approximately 736,000 job vacancies in the UK (8), down 63,000 (7.9%), according to the Office for National Statistics (ONS). This is a consistent trend since peaking in 2022.

Both employment and self-employment are on the increase (120,000 [0.4%] and 70,000 [1.6%] respectively) (9), and there were approximately 37.1 million people in employment as of March 2025, an increase of 187,000 from December 2024.

Despite predictions of increased redundancies following the April employment cost rises, redundancy figures have remained low at 3.5 redundancies per 1,000 employees, consistent with recent trends, according to the ONS (10).

Government data also shows that the UK annual inflation rate, as measured by the Consumer Prices Index (CPI) was 3.4% in May (the latest month for which we have figures)(11). Economists predict that inflation will fall to 3.2% in the fourth quarter of 2025 (12). Lower air fares and fuel prices have driven the inflation figure down, but this was partially offset by increased food prices.

Permanent placements versus temporary billings index

According to the Recruitment and Employment Confederation (REC) permanent staff appointments fell at a moderately quick and sharp rate (13), while temporary billing slowed to the softest in six months. Candidate availability was high, with the steepest growth since December 2020 signalling large increases in both permanent and temporary staff due to increased costs, lower confidence, redundancies and fewer opportunities.

Total vacancies declined at the weakest rate since September 2024 (14), signalling that the downturn in demand for staff has eased.

Rates of starting pay for permanent staff increased modestly during May (15) due to fierce competition for suitably qualified candidates, but according to the REC, pay growth is still weakening for both permanent and temporary staff.

Temp wages grew to a one-year high (16).

Sectoral variation

The South of England and London saw the sharpest reductions in permanent, professional placements, declining by 32% and 29% respectively, according to the REC’s most recent report (17), while the Midlands saw the first increase in placements for over a year. Northern Ireland and the North East have also demonstrated relative strength, with postings 19% and 4% above pre-pandemic levels, respectively.

Temp billings also declined in many areas, most notably the South of England, while the Midlands, bucking the trend again, saw an increase.

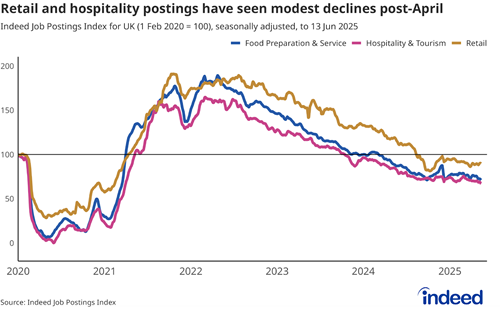

May also saw falls in permanent Hotel & Catering staff as well as Nursing, Medical & Care along with Retail.

The strongest growth was shown in the Engineering sector due to demand for STEM specialists across sectors such as technology, healthcare, renewable energy and manufacturing, according to the Institution of Engineering and Technology (18).

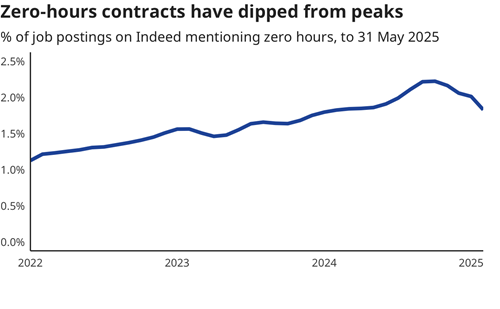

Zero Hours Contracts

Additionally, the number of zero-hours contract roles is declining, in line with the government’s commitment to phasing out such arrangements.

The proportion of job postings advertising zero-hours contracts has dropped from 2.2% in January to 1.8% in May 2025. Research from Allen Associates has shown that up to 35% of Oxfordshire businesses have been affected by this change in legislation.

Oxfordshire outlook

If we focus on Oxfordshire, specifically, the latest ONS Labour Force Survey (LFS) for February - April 2025 (19) show that in the South East of England, the employment rate for 16-64 year olds has risen to 79.1%, up 0.8% meaning that over 360,000 people are in employment in the region (20). The unemployment rate stands at 4.1%, showing a small rise of 0.1% over the same period.

Professional occupations within the region are rising, accounting for 113,268 (27.7%) of all occupations, 13.7% up on 2022 figures. These roles include scientists, researchers, engineers and technologists, as well as people working within the education sector. This demonstrates Oxfordshire’s resilience over the past few years and its ability to attract inward investment into the area.

This has also given rise to an increase in Administrative and Secretarial support roles, up 7.7% to 29,811 since 2022, demonstrating their importance to the area’s functions.

The largest employment sector in the region is, not surprisingly, education, with over 63,000 jobs (15% of all roles in the area) supporting the area’s educational establishments, a rise of 12.9% since 2022. Professional, scientific and technical roles also feature highly with over 57,000 jobs in the sector, constituting 14% of all jobs in the area. Information and communication roles have also risen to almost 30,000, up 30%.

Job vacancy statistics, again from the LFS (21), show that the top occupation in Oxfordshire is ‘Office/Administrative Assistant’, highlighting the region’s strong demand for experienced administrative professionals, a core area of recruitment expertise for Allen Associates.

Skilled candidates remain in demand, with over 45% of Oxfordshire-based employers saying that the biggest challenge they face is the lack of suitably qualified and experienced talent. 22% noted that attracting high-quality candidates presents an ongoing issue.

Priorities for businesses in the Oxfordshire region include adapting to labour market regulations and cost pressures. The labour market in the region remains highly competitive, requiring organisations to balance critical hiring needs against shifting employee expectations. At Allen Associates, we’re seeing employers respond proactively to skills shortages and talent retention by investing in learning and development, as well as in employee wellbeing and benefits, to both attract and retain top talent.

The Oxfordshire labour market

Employment

Oxford has an employment rate of 80.8% for 16-64 year olds, slightly higher than across the South East as a whole.

Unemployment

The current rate of unemployment within Oxfordshire stands at 3.4% for people aged 16+, and shows a slight rise in the figures from last year. The unemployment rate for Oxford itself is slightly higher than across other areas of the South East, demonstrating the county’s strategic importance to the region as a whole.

Key features of the Oxfordshire recruitment market

The following summary has been compiled by Allen Associates based on their first-hand experiences of working with candidates and clients on business support roles across Oxfordshire:

High salary expectations from candidates are the biggest obstacle for employers within the Oxfordshire region, with 61% of employers facing this issue.

Rising operational costs continue to affect Oxford employers. Employment costs (including the National Insurance and Living Wage rises), utilities and raw materials were cited by over 60% of employers as presenting difficulties.

Talent retention is another issue impacting employers in the Oxfordshire region with 58% being impacted by this challenge. Skills shortages have also exacerbated productivity and innovation.

Competition for the best talent remains one of the key issues facing employers in the area.

You can find the latest job postings data for Oxford and Oxfordshire on Indeed’s data portal. Just navigate to the regional tab and select from the dropdowns.

Three long-term changes in the labour market

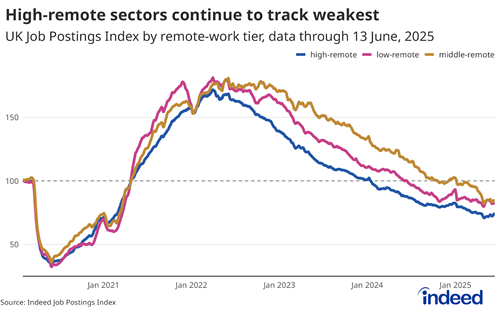

1. Remote work remains in demand

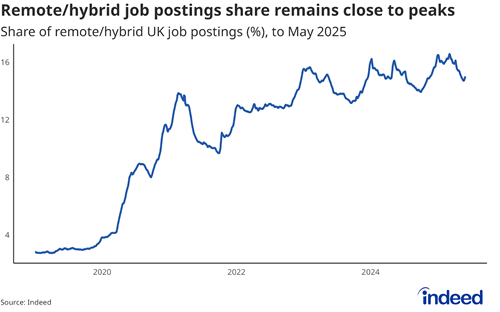

The opportunity to Work from Home (WfH) remains a popular option, despite pushback from many employers. Remote and hybrid working continues to be highly valued by job seekers, with 15% of all postings now mentioning flexible work arrangements. In banking and finance, 39% of roles include this option. However, some sections are pulling back on remote offerings: tech (-48%), media and communications (-48%), marketing (-37%), project management and HR (both -27%).

In contrast, roles requiring a physical presence, such as nursing (-66%) and beauty & wellness (-51%) remain significantly below baseline. Conversely, education & instruction (+49%), social sciences (+48%) and real estate (+45%) show strong above-baseline demand.

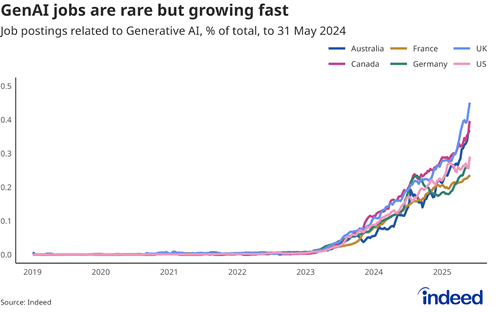

2. AI Integration and labour market shifts

The adoption of AI continues to affect the availability of entry-level roles. However, according to the Organisation of Economic Co-operation and Development (OECD), in future it also has the potential to disrupt white collar occupations such as lawyers, doctors and software engineers. While we’re not seeing this at the moment, and while Gen AI-related positions remain a small segment (0.5% of job postings) they are growing rapidly, with the UK emerging as a leading adopter of the technology among developed nations. Furthermore, the International Monetary Fund (IMF) has indicated that up to 60% of jobs in developed economies will be exposed to AI in the future, with half of those being a negative experience.

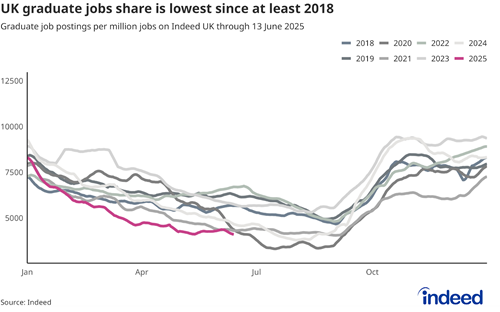

3. Graduate opportunities contract

Graduate roles have decreased by 33%, the lowest since 2018, with overall job postings down 5% from March to June. A survey by the Institute of Student Employers has shown that the average company now receives 140 applications for each vacancy (22), and that 1.2 million applications were received for 17,000 positions. This trend reflects employer caution, with many organisations choosing to retain existing staff rather than bring in new talent, in addition to dealing with higher employment costs. The integration of AI in entry-level roles is likely to have contributed to reduced demand for graduate hires.

What does it mean for your hiring?

1. Talent shortages persist, despite high demand

Highly-skilled and experienced candidates will remain in demand, with almost one-third of UK businesses reporting labour shortages.

2. Salary and benefits packages

A competitive salary remains at the top of candidates’ wish lists, but supportive benefits packages are also becoming more popular, not only to attract candidates but to retain current workers. Wellbeing & mental health initiatives, as well as training and development opportunities, are the most in-demand.

3. Hybrid work remains popular with candidates

With many employers already offering flexible working arrangements to attract and retain talent, its popularity remains high. Employers must balance employee mental wellbeing and freedom of choice with partial office attendance to ensure effective teamwork.

4. Workplace culture matters

Millennials and Gen Z continue to seek job security, career alignment and a fair hiring process. They also value DE&I highly. Employers seeking to attract these demographics should highlight these features in their employer branding, emphasising inclusive cultures, career progression and workplace flexibility.

5. Soft skills emphasised

With AI and automation being used increasingly in both the recruitment process and the workplace, soft skills such as problem solving, communication and teamwork are becoming more important. Employers should place value on these skills as well as a candidate’s experience and qualifications.

Recruitment advice for Oxfordshire employers

The team at Allen Associates has been supporting businesses in PA & Administration, Marketing, HR, and Finance recruitment across Oxfordshire for over 27 years. As we enter the second half of 2025, the employment market presents a mix of challenges and opportunities, with businesses adjusting their hiring strategies in response to economic conditions, evolving workforce trends, and shifting business needs.

Kate Allen, Founder & Executive Chair at Allen Associates

“As we move into the second half of 2025, the UK labour market remains dynamic, presenting a mix of resilience and uncertainty. Despite subdued GDP growth (1.1%) and unchanged interest rates (4.25%), business and consumer confidence is slowly rising. Government investment in priority sectors such as STEM, defence and energy is expected to lift growth to 1.2% over the coming year.

Hiring conditions remain complex. The UK labour market is gradually loosening, with a slight rise in unemployment, and job vacancies declining to 736,000. Yet demand for skilled professionals persists. Almost one-third of UK businesses report labour shortages, with salary and benefits now pivotal in attracting and retaining talent. Employers are under pressure to balance growing employment costs, including April’s National Insurance and minimum wage hikes, with the need to remain competitive in a tight candidate market. AI and automation are reshaping job availability, particularly in entry-level roles, contributing to a 33% fall in graduate hiring. While adoption remains uneven across sectors, AI’s impact on white-collar roles is expected to grow. Meanwhile, remote and hybrid work remains in high demand, especially in knowledge-based industries.

Permanent placements have slowed across much of the UK, though temporary hiring remains resilient. Regional variations are stark, with London and the South seeing sharp drops in hiring activity, while areas like the Midlands and Northern Ireland show more buoyant trends.

To stay ahead, UK employers must invest in wellbeing, training and workplace culture, placing equal weight on soft skills, DE&I, and flexible working policies.”

Eleanor Bromage, Managing Director at Allen Associates

“Oxfordshire’s employers are navigating a challenging hiring environment in the second half of 2025, characterised by cost pressures, skills shortages and shifting workforce expectations. While the broader UK economy faces modest growth (1.1%) and inflation softens (3.4%), the Oxfordshire recruitment market remains competitive.

Over 45% of local employers report challenges sourcing suitably qualified talent, with 61% citing high salary expectations as a key hiring obstacle. Rising operational costs, including national wage increases and energy bills, continue to squeeze margins. Despite this, employers are showing resilience by investing in learning, wellbeing and flexible work to attract and retain high-quality candidates.

Zero-hours contracts are on the decline, aligning with national trends and legislative shifts. Meanwhile, redundancy levels remain low despite the rising cost of employment, a positive indicator of employer confidence. Oxfordshire businesses are adapting by prioritising value-adding skill sets, particularly in specialist roles. Candidates, on the other hand, are seeking flexibility, career development and purpose-driven organisations.

AI and automation are reshaping the labour market, influencing hiring strategies and reducing demand for graduate roles. Hybrid working remains in high demand, though some sectors are beginning to scale back remote options.

Allen Associates’ experience highlights that successful Oxfordshire employers are those who align their offering with evolving candidate expectations, particularly around workplace culture, autonomy and soft skills. In a tight market, responsiveness and a people-first approach are key.

As the second half of 2025 unfolds, Oxfordshire’s businesses must remain agile, proactive and committed to building resilient, future-ready teams.'

What are Oxfordshire employers looking for in their new hires?

- High quality candidates

- Both temporary and contract staff, in addition to permanent staff

- A range of relevant skills

- Experience in a wide variety of roles

- Excellent technical skills, with an increasing focus on AI specialisation

- Good candidate fit

- Commitment

What are candidates looking for from their new employers?

- Competitive salary

- Structured career progression

- Wellbeing and mental health initiatives

- Flexible roles, including temporary, temp-to-permanent and contract

- Learning and development as well as upskilling opportunities

- Flexible working, including hybrid, compressed hours and job-sharing

- Retention initiatives

- Strong workplace culture

- Benefits packages

- Mentoring programmes

- Clear progression pathways

- DE&I initiatives

Hiring in Oxfordshire

If you’re looking for quality, pre-interviewed candidates for your business support roles in Oxford or elsewhere in Oxfordshire, we would love to hear from you.

Based in Oxford, Allen Associates has been matching great people to roles and employers for more than 27 years. We apply the same rigorous recruitment processes to our temporary and permanent vacancies, so whatever your needs, you can be confident of an excellent service underpinned by passion, personality and integrity.

For support with your next hire please call us on 01865 335600 or email us at hello@allen-associates.co.uk

Useful contacts and more insights

Allen Associates runs monthly webinars on a wide range of people management topics led by guest speakers, as well as quarterly Employment Law Updates with our legal partner, RWK Goodman. To find out more and register for these free events, please visit Allen Associates HR Hub page on our website.

The very latest data and insights on the UK labour market are available at Indeed’s Hiring Lab.

Recruitment industry news and information is available from the Recruitment & Employment Confederation (REC).

For more on the Oxfordshire economy, visit the Oxfordshire Local Enterprise Partnership (LEP).

Previous Oxfordshire Recruitment Market Overviews are available to download from Allen Associates Knowledge Centre.

Recruiting Excellence

allen-associates.co.uk

hello@allen-associates.co.uk

01865 335600